Considering Portugal's Golden Visa Program? Everything you need to know + how to qualify with 325,000 EUR

If you're interested in finding out the latest details about the Golden Visa program and want to take advantage of the new opportunities. Signup for a live Q&A webinar with an expert from Holborn Assets that will answer all your questions. The event is scheduled for December 4 at 5 PM Lisbon Time (1 PM EST). The live webinar will cover the following:

- Golden Visa basics, how to qualify, who can be included

- New Investment Criteria for 2024

- Golden Visa timeline and process

- How to qualify with just 325,000 EUR - this exclusive offer includes investment loan financing to bridge the gap to reach the 500k minimum investment

- What tax breaks are available?

- Live Q&A for all questions

*If you cannot attend the seminar or would prefer one-on-one, book a call here.

Portugal’s Golden Visa Still Available in 2025

In June 2023, the government announced that the Golden visa scheme would continue despite the option to apply for the Golden visa through real estate going away. As of 2025, there are still plenty of other investment avenues and the program remains one of Europe’s most flexible pathways to EU residency.

The current investment routes include:

- Donation to Arts €250,000

- Venture Capital/Private Equity Fund €500,000

- Donation to Research Activities €500,000

- Company Creation 10 employees or €500,000 + 5 employees

What is the Portugal Golden Visa?

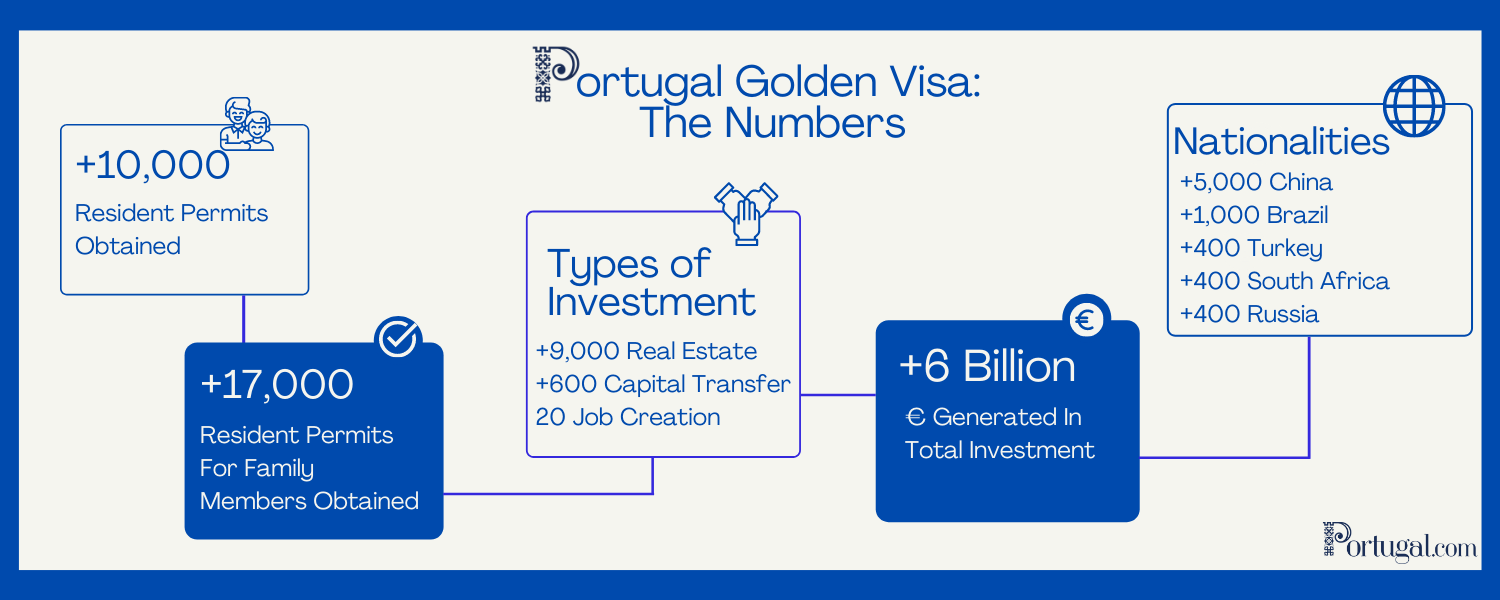

Created in 2012, the Portugal Golden Visa is known as one of the most attractive in the world. The Portugal Golden Visa was created to boost foreign investment to benefit the Portuguese economy. The program allows non-EU citizens to qualify for a residency permit and eventually a passport in the country through investments.

With a Portugal Golden Visa, you can live in Portugal and travel within most European countries without an issue. However, you do not need to live in Portugal to be eligible for this visa. All you need to do is to stay in the country for at least 7 days in the first year and 14 days in the subsequent years. You obviously also need to engage in an investment, which we will get to.

Guide to Portugal Visas

What are the Benefits of the Portugal Golden Visa?

1. Visa Exemption

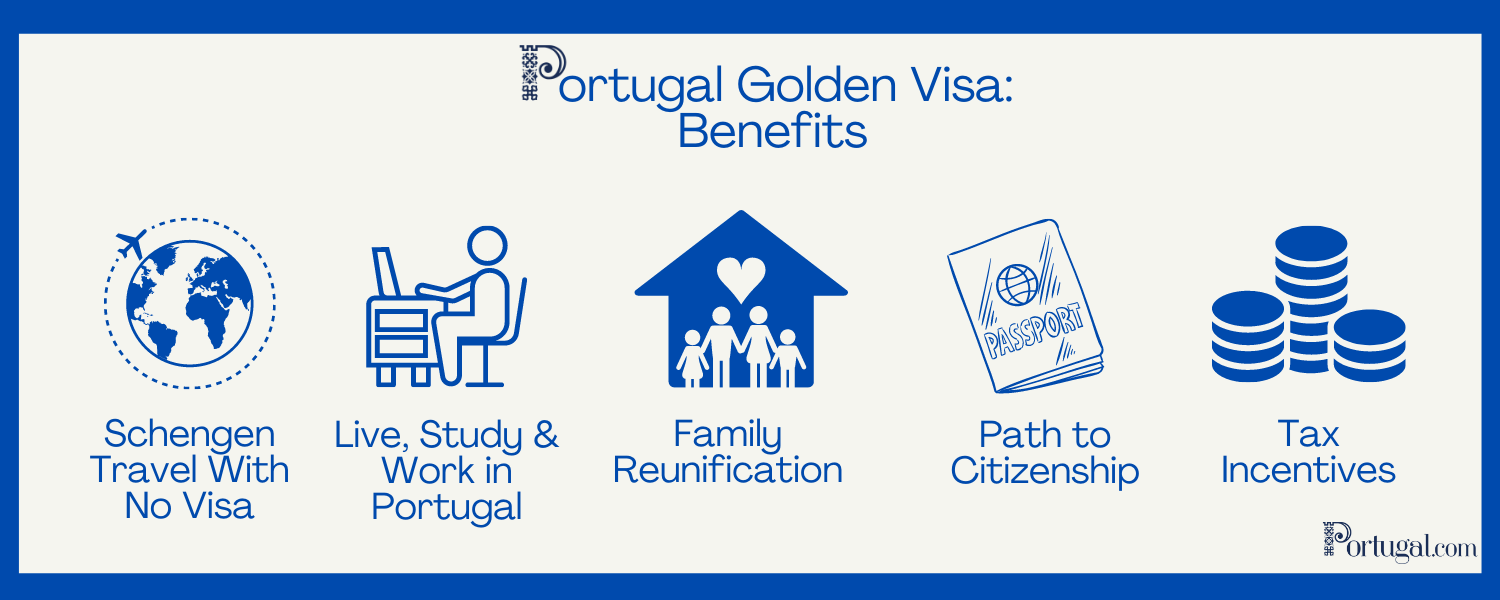

The Portugal Golden Visa allows you to enter Portugal and the Schengen area (26 EU Countries). You can travel freely without requiring a visa, essentially granting you the travel privileges of European Union citizens.

2. Ability to Stay in Portugal

The visa grants you the right to live, study and work in Portugal as if you were an EU citizen.

3. Family Perks

The Portugal Golden Visa does not only grant the investor privileges but also their family members. The program includes family reunification, meaning that a spouse, minor children, children over 18, children over 18 who are studying, and parents who are financially dependent on the investor are all granted the same rights. They can all live and work in Portugal and travel freely within the Schengen area, as well as enjoy all the visas’ benefits.

4. Permanent Residence: Does the Portugal Golden Visa Lead to Residence?

The investor can apply for permanent residence if they follow all the requirements and complete the 5 years necessary.

5. Citizenship: Does the Portugal Golden Visa Lead to Citizenship?

After legally residing in Portugal for at least 6 years, the investor can apply for Portuguese citizenship and potentially obtain a passport. However, to get citizenship you must obtain an A2 Portuguese language certificate, prove you have links to the country such as through your investment, provide documents such as proof of a Portuguese bank account, and have no criminal record.

6. Tax Incentives: Non-Habitual Resident Tax Regime in 2024

Guide to NHR Tax Regime 2.0

The Portugal Golden Visa provides some inviting tax incentives. You will not be faced with any tax responsibility unless you become a tax resident, meaning you spend more than 183 days of the year in Portugal.

If so, under the Portugal Gold Visa, you might also be able to become a Non-Habitual Resident (NHR) tax regime if you are eligible under recently more strict conditions. Here are the benefits of this tax regime:

- Income is taxed at 20%

- You will only be taxed on your worldwide income after the first 10 years of residence.

- Foreign interest, dividends, rents, and property capital gains can be exempted from taxation. You will also not pay an inheritance or wealth tax.

Keep in mind that the initial NHR that was initiated in 2009 ended in late 2023, but a new NHR 2.0 is now in place with similar benefits. The benefits remain almost the same, but the pool of those who can apply has become a lot smaller. Moreover, the new regime focuses on employment, primarily scientific research, and innovation, while no longer benefiting retirees and other high-value jobs.

Want to become part of the large community of US expats in Portugal? Sign up for Holborn Assets’ live webinar on the challenges facing US connected clients moving or living in Portugal. Find out all about the financial perks of moving to Portugal and have all your burning questions answered. The event is scheduled for May 16 at 5 pm (Lisbon Time) / 12 pm EST. If you would like to schedule a one-on-one call instead, you can book one here.

Who can get a Portugal Golden Visa?

You are eligible for a Portugal Golden visa if you are a non-EU/EEA/Swiss national. You need to be at least 18 years old and have no criminal record. The main requirement is that you make an investment in Portugal, which will be explained in detail in the next section. Keep in mind that property is no longer an accepted investment route.

Life After Brexit: Why Should UK Nationals Apply for a Portugal Golden Visa?

Since January 1st, 2021, UK citizens are eligible to apply for the Portugal Golden Visa which allows them to travel freely within the Schengen Area. This is a great option for UK nationals who want to enjoy some benefits, essentially getting back most of the EU citizen rights that were lost in Brexit. A UK national with a Portugal golden visa can travel freely through the Schengen area (26 EU Countries). A UK national will then also have the right to work, study, and live in any EU/EEA country. They will also be able to apply for residence and later on, citizenship, granting a UK national an EU passport.

Why the Golden Visa Is Still Attractive in 2025

- Minimal stay requirement – Investors still only need to spend seven days in the first year and 14 days every two years. This means you can keep your life abroad while gradually building ties to Portugal.

- Family‑friendly – Spouses, dependent children, and parents can be included in one application. Everyone receives the same rights to live, study, and work in Portugal.

- Schengen mobility – Your residence card allows visa‑free travel across the 26 Schengen countries.

- Path to EU citizenship – Under current rules you can apply for Portuguese citizenship after five years of legal residence, provided you learn basic Portuguese (A2 level). Legislation passed in October 2025 proposes extending this to ten years for most nationalities, but it is not yet in force. By applying now, you benefit from the existing five‑year timeframe.

- Improved digital processes – Portugal’s new migration agency (AIMA) is rolling out a fully digital Golden Visa platform in January 2026. It promises smoother submissions, integrated payments, and quicker biometric appointments. Renewals already use an online portal.

- High quality of life – Portugal offers affordable living, a pleasant climate, low crime, excellent infrastructure, and a hybrid public–private healthcare system ranked 23rd among high‑income nations. Golden Visa residents can register with the Serviço Nacional de Saúde (SNS) and enjoy largely free public healthcare.

Golden Visa Application Costs: How much does the Portugal Golden Visa Application Cost?

There are a number of government application fees when applying for a Portugal Golden Visa. The processing fee is around €550 at the beginning and then you will have to pay around €80 for each renewal. The initial application fee is around €5,325 per person, a one-time payment. The renewal application fee costs €2,663 per person. If you want eligible members to also have a Golden Visa, you must pay this fee for them, as well.

Also, expect to pay a legal fee and prices will depend on the law firm and investment types. The prices usually start from €5,000 for legal costs. However, a lawyer’s help will make the whole bureaucratic application process a lot easier.

Portugal Golden Visa: Healthcare in Portugal

Portugal has a strong National Health Service called SNS, which takes the 17th spot on the World Index of Healthcare Innovation. If you obtain a Portugal Golden Visa, you can register with the SNS and access public healthcare. After you obtain your visa, you must register with the local health care center using your residence card. You will then be provided with your healthcare number that you will need to access public health care.

The SNS provides multiple services from emergency treatment, psychiatric care, and maternity care. Most services are free. However, there are certain particular services such as visiting energy rooms or diagnosing exams that require payment. Usually, the prices range from €5 to €20. SNS services are completely free for children under 18 and those over 65. Dental care is not included in the SNS.

Aside from the SNS, Portugal also has private hospitals as it has a hybrid public-private health system. If you have a Portugal Golden Visa, you can purchase private insurance so that prices are more affordable. Health insurance prices range from €300 to €1,000 a year, depending on the company and other personal factors such as your age.

International comparisons paint a rosy picture. The 2025 mid‑year Numbeo Health Care Index ranks Portugal 23rd out of 95 countries, while the World Index of Healthcare Innovation 2024 places Portugal 23rd among wealthy nations. There are 241 hospitals nationwide, with 127 private facilities, and the country spends 10.5% of GDP on healthcare.

Beyond healthcare, Portugal offers beautiful coastlines, historic cities, a Mediterranean climate and high safety rankings. Many Golden Visa investors split their time between Portugal and their home country. They can enjoy sunshine and quality of life without giving up existing careers or businesses.

2025 Investment Routes

Although real‑estate purchases no longer qualify, Portugal has diversified its program into culturally and economically rewarding pathways.

Fund Investment – €500 000

Invest in regulated venture‑capital or private‑equity funds supervised by the Portuguese Securities Market Commission. Funds cannot invest into real estate, ensuring your capital supports Portuguese businesses. Many investors favour this route because the fund manager handles compliance and reporting.

Arts & Cultural Donation – €250 000 (may be €200 000 in low‑density areas)

Support projects that preserve Portuguese heritage or fund cultural production. Pre‑approved initiatives range from restoring historic buildings to funding exhibitions. Contributions in designated low‑density areas benefit from a 20 % discount.

Scientific Research Donation – €500 000

Finance public or private scientific research institutes recognised by Portugal’s national science system. This option appeals to investors wishing to advance medicine, technology or renewable energy.

Job‑Creation – Create 10 jobs (or 8 in low‑density areas)

Establish a Portuguese company and employ at least ten people (eight if based in a low‑density area) for five years. There is no minimum capital requirement, making it a flexible entrepreneurial pathway.

Business & Capital Investment – €500 000 + 5 jobs

Invest €500 000 in an existing Portuguese company or start‑up and create five new jobs for three years. This option lets you partner with local businesses and share profits while meeting visa requirements.

The Application Process

- Consult a specialist or expert. Engage a licensed advisor to discuss your goals, review the available investment options and ensure you understand all legal requirements.

- Gather documents. Collect passports, birth/marriage certificates, criminal‑record checks, proof of health insurance and evidence of financial means. Having these ready from the start will speed up the process.

- Obtain a Portuguese tax number (NIF) and open a bank account. Lawyers can assist remotely with securing an NIF and setting up a local account to hold your funds.

- Make your investment. Complete the qualifying investment you have chosen and obtain proof of transfer along with any declarations from the sponsoring fund or project.

- Submit your online application. File your Golden Visa request via AIMA’s ARI portal. A new digital platform launching in January 2026 will further streamline this step.

- Attend biometrics. Schedule an appointment in Portugal or at a consulate to provide fingerprints and photographs. The current backlog means appointments may take several months, but AIMA has prioritised Golden Visa cases and is clearing backlogs.

- Receive your residence card. Once your application is approved, you will be issued a residence permit. Renewals every two years require proof of continued investment and time spent in Portugal.

Costs and Fees

Government fees rose slightly in 2025 but remain competitive relative to other EU programs

| Item | Approximate Fee |

| Processing fee (per applicant) | €605 |

| Residence card issuance | €6,045 |

| Renewal fee (every 2 years) | €3,023 |

| Additional processing per dependent | €83 |

Legal fees typically range between €5,000 and €10,000 and can vary depending on your individual circumstances. Fund managers can charge management fees, and donations or business investments may involve administrative costs.

Legislative Horizon

A word of caution: Portugal’s Parliament approved a new Nationality Law in October 2025 that would extend the residency requirement for citizenship from five to ten years for most applicants and introduce a civic knowledge test. The law is not yet enacted; it awaits presidential promulgation and potential constitutional review.

Final Thoughts

Portugal’s Golden Visa program has adapted but remains a beacon of opportunity. Its shift away from real estate encourages investments that foster innovation, culture and jobs. Meanwhile, the country continues to offer sunny weather, rich culture, modern healthcare, and a welcoming environment. By choosing a qualifying investment and working with experienced advisors, you can secure a Portuguese home base while maintaining global flexibility.

Join our FB group Portugal Travel & Living for all things Portugal and visa updates

Considering Portugal's Golden Visa Program? Everything you need to know + how to qualify with 325,000 EUR

If you're interested in finding out the latest details about the Golden Visa program and want to take advantage of the new opportunities. Signup for a live Q&A webinar with an expert from Holborn Assets that will answer all your questions. The event is scheduled for December 4 at 5 PM Lisbon Time (1 PM EST). The live webinar will cover the following:

- Golden Visa basics, how to qualify, who can be included

- New Investment Criteria for 2024

- Golden Visa timeline and process

- How to qualify with just 325,000 EUR - this exclusive offer includes investment loan financing to bridge the gap to reach the 500k minimum investment

- What tax breaks are available?

- Live Q&A for all questions

*If you cannot attend the seminar or would prefer one-on-one, book a call here.

I understand that “residency” for purposes of obtaining either permanent residency or a passport after 5-6 years under the Golden Visa program means living in Portugal for at least half of each year. Is that correct?

That is my understanding too. However, we advise you to contact an immigration lawyer.

Last most people, I have a stock portfolio. If I move to Portugal, I understand that Portugal will impose 28% tax on capital gains from my stocks.

Based on your steps, I would need to travel to Portugal and buy the real estate property before applying. But, I would only buy the property for the purpose of living there. So, if Portugal does not accept my application, I would need to sell the property, which would be a hassle.

Let’s say my stock portfolio is valued at more than €1.5 million. Let’s say I open a brokerage account with a Portugese brokerage account and transfer my stocks to the Portugese brokerage account. Will this qualify as the “Capital Transfer” for the golden visa?

My intention is to move to Portugal to live there and reduce taxes. From your description, it sounds like I would get the Golden Visa and the Non-Habitual Residence tax regime. Is that correct? It’s confusing that it is call Non-Habitual, if I want to live there habitually and permanently.

Hi Chris,

I recommend contacting an accountant or immigration lawyer in Portugal to access your situation.

I wonder with the 10 full time job creation… can it be from any type of business or does it have limitations?

Hi Robyn,

I recommend contacting an immigration lawyer as unfortunately, that information is not widely available.

If Lisbon, Porto and coastal towns do not qualify as a real estate investment toward a golden visa, how close can one live to these areas and still qualify? Do suburban towns around cities such as Porto and Lisbon qualify?

Hi Jeffers!

I recommend you find an immigration firm (many specialize in the Portuguese Golden Visa) as they will have these full details.

Hello Jeffers, by coincident I was reading this article and messages. As a real estate professional, I understand some facts about questions posted in here.

Under the new policy, Lisbon, Porto and coastal towns area are no longer qualified for RESIDENTIAL real estate investment for golden visa, BUT commercial i.e. offices, shops, tourism and holiday resorts still applicable, and there are couple of tourism resorts developments are available in Lisbon district.

Melody Rae

Hi Melody. I invest in apartment buildings. Would apartment buildings in Lisbon, Porto, or other coastal towns qualify as commercial, or would that be considered a residential investment? Thanks! Robert.

So major cities such as Lisbon are no longer options for purchasing real estate to qualify for the Golden Visa program. What about Cintra and Algarve? Can one still purchase property in these two cities?

You will not be eligible by purchasing a residential property in Lisbon, which includes Sintra, Cascais, etc. The same with the Algarve. We recommend contacting an immigration lawyer to find out where you can still purchase a house.

Hello Madge, by coincident I was reading this article and messages. As a real estate professional, I understand some facts about questions posted in here.

Lara Silva is absolutely correct that under the new policy, Lisbon including Sintra, Porto and Algarve area are no longer qualified for RESIDENTIAL real estate investment for golden visa purpose, except for commercial i.e. offices, shops, tourism and holiday resorts still applicable, and there are couple of tourism residential resorts developments are available in Lisbon district.

Melody Rae

If I buy property for the required minimum amount in one of the areas that are still eligible for the Golden Visa opportunity, do I have to continue owning that same property for 5 years in order to apply for permanent residence in Portugal? Or can I buy property in one town and sell it to buy another one in Lisbon or in a beach town that is currently not eligible for Golden Visa as long as my first investment in property was in an eligible town?

Hi Sandy,

I am not sure this is possible. I recommend contacting an immigration lawyer.

Hello Sandy, by coincident I was reading this article and messages. As a real estate professional, I understand some facts about questions posted in here.

Property bought for GV purpose required the investor’s continued ownership for the invested property to be eligible until their GV process completed (5-6 years approximately), once their GV process is completed, no obligation required for investors to maintain the same investment, which mean, you can resell or switch for other property wherever you wish.

Melody Rae

How safe are the investments in Portuguese investment funds (option 2 above)? What kinds of funds qualify? Can I find any of them on exchanges or that are published and track them? Is it like buying the S&P 500 or National Bonds of Portugal or is it more like penny stocks and private real estate funds where you could easily lose all your money?

Hi Gordon,

There are many financial specialists and immigration lawyers in Portugal that will best advise you. I recommend researching some that are specialized in the Portuguese Golden Visa.

Hi.

Does the Golden Visa offer unlimited time spent in other Schengen countries or is it limited to 90 in any 180 days as the D7.

Thanks

I’m not an immigration lawyer, but I believe that the Golden Visa does not equate with an EU Citizen’s ability to travel and stay in the Schengen without limits. You would still only be allowed in the Schengen for 90 of 180 days until you receive the Portugal passport.