What is the Portugal D7 Visa?

Also known as the Retirement or Passive Income Visa, the D7 Visa is a long-term residency visa that was introduced in 2007 and unlike the Portugal Golden Visa requires no investment. Along with retirees, this visa is suitable for some remote workers and digital nomads. This visa is for non-EU/EEA/Swiss citizens who want residence in Portugal and have a reasonable passive income. This income can be from a retirement pension, as well as a financial investment, and real estate.

The minimum passive income required is €9,120 per year for the main applicant. For a spouse, you must add 50% to this (€4,560) and for a dependent child, you must add 30% to this (€2,736). Therefore, for a couple with one child, you would need around €16,416 a year to be eligible for the D7 Visa.

Portugal D7 Visa Requirements

The requirements to be eligible for a D7 Visa in Portugal are pretty straightforward. Here are the main eligibility criteria for the Portugal D7 Visa.

- Non-EU/EEA/Swiss citizen

- Minimum passive income of €9,120 per year (+ 50% for spouse and + 30% for dependent child)

- Clean criminal record

- Proof of residence address in Portugal (rental or purchase)

- You need to spend at least 16 months in Portugal during the first 2 years.

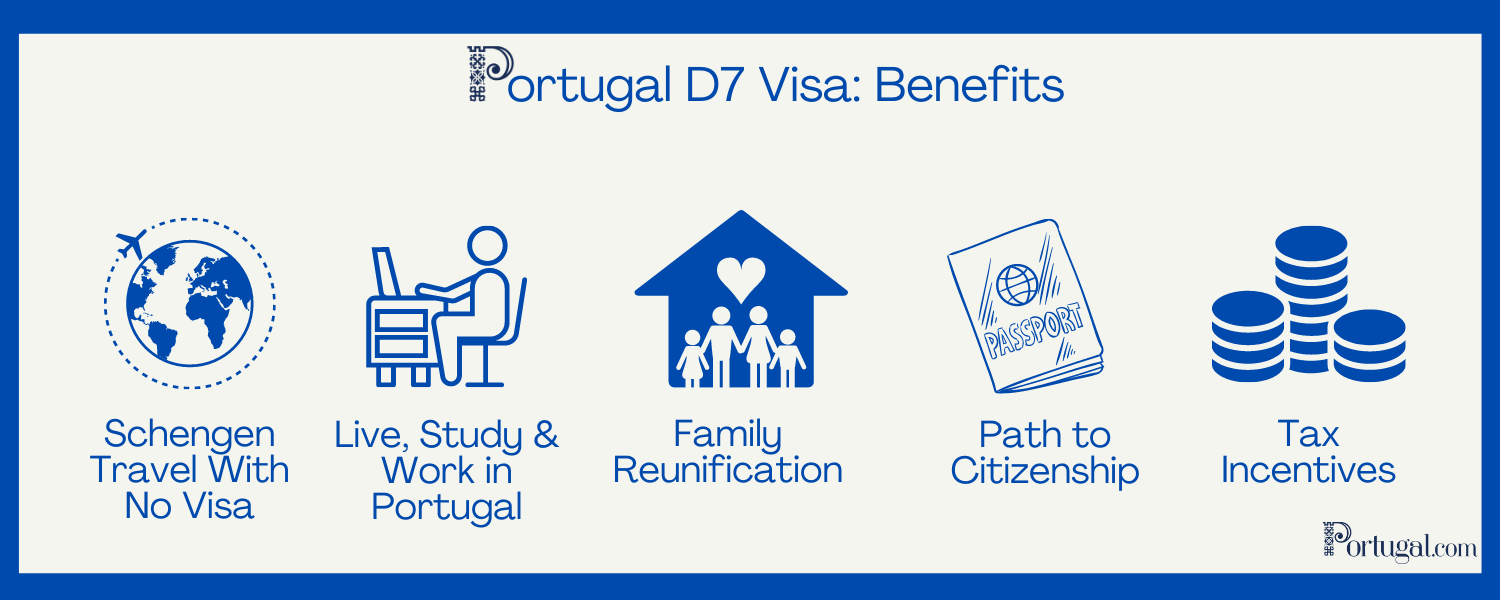

What are the Benefits of the Portugal D7 Visa?

1. Visa Exemption

The Portugal D7 Visa allows you to enter Portugal and the Schengen area (26 EU countries). You can circulate freely without a visa. The D7 visa essentially grants you to the travel rights of all European Union citizens.

2. Family Perks

The Portugal D7 Visa allows you to request family reunification once you have your visa. This is where your family members are granted the same residency rights as you. You will have to prove your relationship to any family members that you would like to include in the program. The following qualify for family reunification: partner, children under 18, dependent children over 18 that are studying, your parents, your partner’s parents, and minor siblings. These can all live and work in Portugal and travel freely within the Schengen area, as well as enjoy all the visas’ benefits.

3. Permanent Residence: Does the Portugal D7 Visa Lead to Residence?

The Portugal D7 Visa allows you to obtain permanent residence, eventually. You can obtain legal residency in the first year. You can then renew your residency for two years successively. After five years of legal residency, you can apply for permanent residency.

4. Citizenship: Does the Portugal D7 Visa Lead to Citizenship?

The Portugal D7 Visa can lead to citizenship. After five years of legal residency, you can apply to become a Portuguese citizen. To become a citizen, you must obtain an A2 Portuguese language certificate, provide documents such as proof of a Portuguese bank, and have no criminal record.

Who can get a Portugal D7 Visa?

Non-EU/EEA/Swiss citizens who have a passive income can apply for a Portugal D7 Visa. Although this visa is also known as the retirement visa, if you can work remotely for an employer outside of Portugal, you might also be eligible. Therefore, freelancers and digital nomads who meet the requirements can still apply for the D7 Visa.

Life After Brexit: Why Should UK Nationals Apply for a Portugal D7 Visa?

If you’re a British national who cannot afford the investment necessary for the Portugal Golden Visa, the D7 Visa is the right route for you. You will enjoy permanent residency and possibly citizenship after 5 years, allowing you to get back your EU rights lost after Brexit. As a UK national with a D7 Visa, you’ll be able to travel freely through the Schengen area, as well as have the right to work, study, and live in any EU country.

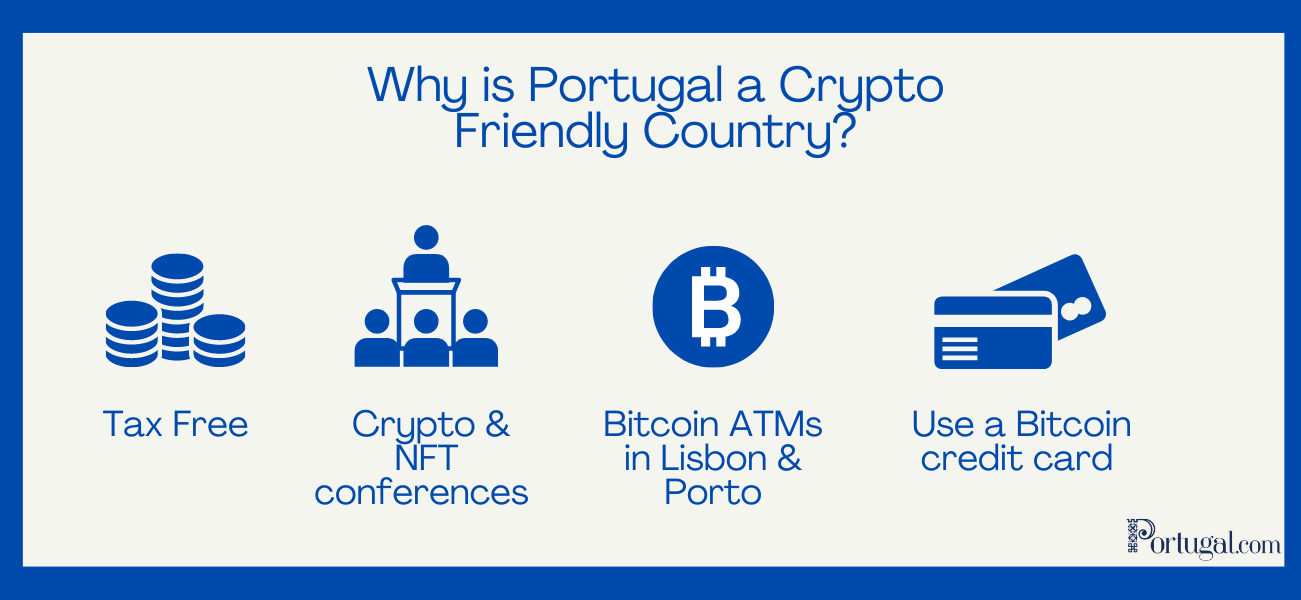

Portugal D7 Visa: Cryptocurrency

Portugal is one of the last European crypto havens. Portugal introduced a new crypto tax law in 2023 that applies a 28% capital gains tax on short-term crypto holdings (less than 365 days). Almost all crypto assets that you hold for over a year, except for certain tokens like securities and those from specific jurisdictions, are tax-free, except for certain tokens like securities and those from specific jurisdictions. However, businesses that provide services related to cryptocurrency are taxed on their gains. There are many factors that determine whether this is the case like your profit and the frequency of your trade. To be sure, contact a tax advisor in Portugal.

Take a look at our guide to cryptocurrency in Portugal here.

Portugal D7 Visa: Healthcare in Portugal

You will need to purchase health insurance for the four-month duration of your D7 Visa, which should cost between €20 and €50 a month. After this period, you will obtain your residency and can then access the Public Health Care system (SNS). The Portuguese health system is world-renowned, taking the 17th spot on the World Index of Healthcare Innovation. You will have to register with the SNS in your local health care center. Most services with the SNS are free, but you will have to pay for particular services such as specific exams. However, these prices won’t cost more than €5 to €20. Dental is not included in the SNS.

You can also just access private hospitals if you wish. Yearly health insurance prices range from €300 to €1,000 depending on the company and other personal factors such as your age.

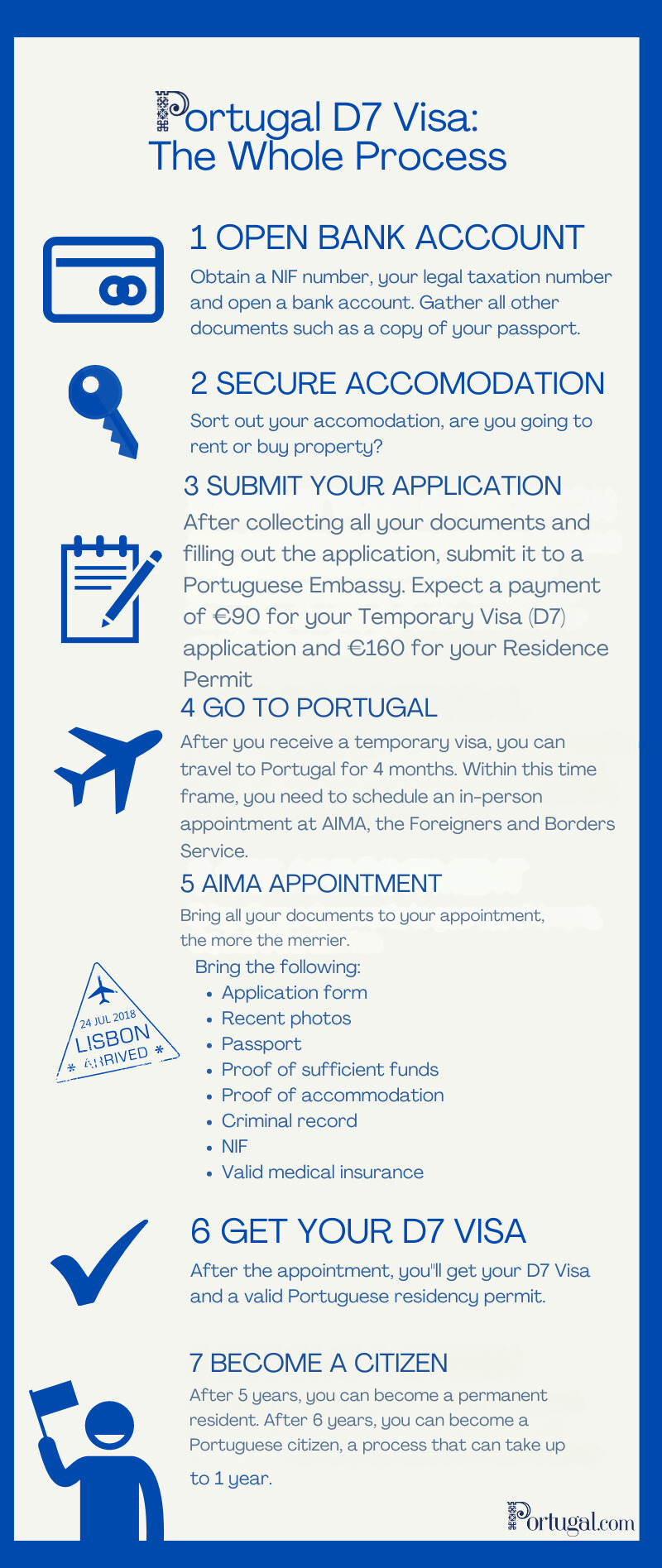

Portugal D7 Visa Steps & Application Process: How to Get a D7 Visa

While the application process for the Portugal Golden Visa can take 9 to 12 months, you can get a Portugal D7 Visa in less than 4 months! Take a look at the full application process, step-by-step.

Portuguese Embassies in the US, UK and Canada

Hello

Pakistanis can also apply?

Hi Tanveer!

Yes, any non-EU/EEA/Swiss citizens who have a passive income can apply for a Portugal D7 Visa.

How. Can you please help me

Hi Lara

Is it a requirement that some documents be apostilled for the D7 visa application?

(applying as South African family, but permanent residents in Canada).

Thanks 🙂

Hi Adele,

I would contact the nearest Portuguese embassy or contact an immigration lawyer about your question to be safe!

Thanks

Lara

Is there any age limit?

Hi Mohamed!

I believe you only need to be over the age of 18, but contact the Portuguese embassy or an immigration lawyer to be sure 🙂

Thanks,

Lara

You can also request a free consultation from http://www.D7visa.com by filling out your details, although they may not respond if you’re not eligible.

do you need to prove future income for the second year? does this need to be deposited into a Portuguese bank account or can it be from future income?

Hi Stephanie! From what I read, for your application, you would show proof of income for 12 months. However, I suggest contacting an immigration lawyer to clarify the issue.

Hi Lara!

Is it possible for my husband and I to apply together on ONE application for a D7? I would be the primary applicant and he the dependent. Or is family reunification the only way?

If we split our assets, we would not qualify financially with 2 independent applications.

Thank you!

Hi Sarah! From what I have read, you can apply as a married couple, as you said with a primary applicant and dependent. However, you would need to show that you have a minimum income of €8,460 per year + 50% for your spouse. I would recommend contacting an immigration lawyer.

Hello Lara,

I am earning 1000 euro per year as a freelancer. Can I apply for this visa ?

Hi Waqas! Unfortunately, you need to make €8,460 per year to be eligible for the D7 Visa.

For Step #1, do you have to physically be in Portugal for either or both getting the NIF or opening a bank account. Either way, how do you do it?

For Step #2, is it really possible to rent an apartment or house without already having a visa? Do you have to be physically in Portugal to do it? How do you do it?

For Step #5, how do I find out if my situation counts as “sufficient funds”? Do stock dividends count for passive income (because the amount is not guaranteed). Also, I will be changing from teaching full time to online tutoring. How much will I have to make with my online tutoring and for how long to I have to make that much before it counts as proof?

I know I have a lot of questions. I would be willing to pay for answers. Is there some service that you can recommend?

Thank you!

Hi Kendon!

For #1, you can get a temporary NIF and bank account from a Portuguese lawyer who acts on your behalf, you don’t need to be in Portugal.

For #2 You can rent an apartment without a visa, again through a Portuguese lawyer. I recommend contacting a real estate agency to help you out like remax, but there are plenty more.

For #5, from what I have read stock dividends count as passive income. I would recommend contacting a lawyer as the information on this is confusing, some say you need proof of income for the last 3 months and some say the last 12 months. If you have proof of income for the last 12 months you should be fine. The minimum you need to me is 8,460 euros a year and it seems you are already making this with your stock dividends.

Again, I recommend contacting an immigration lawyer in Portugal to have all your questions answered more meticulously and carefully.

Just to clarify, you can rent an apartment remotely without needing to be in Portugal, correct?

I saw on a video that the bank needs proof of apartment rental before they will open the account and the apartment needs proof of a bank account before they will rent the apartment. How are we supposed to open a bank account or rent an apartment if this is the case?

Hi Chris,

This is possible, yes! You can also open a bank account remotely, but this has an extra cost. Check out this article https://www.portugal.com/moving-to-portugal/how-to-open-a-bank-account-in-portugal-as-a-foreigner/

BTW, my stock dividends currently pay €27,000 per year and my tutoring, once I build up my clientele, would pay €10,000 – €20,000. But once, again, for how long do I have to make that before it counts as proof?

Hey Lara,

Are there any immigration lawyers you recommend?

Cheers,

Alex

Hi Alex,

I have not worked directly with these law firms, but they seem to specialize in D7 visas so maybe take a look 🙂

https://www.ada-legal.com/en/portuguese-d7-visa/

https://www.filipeespinha.pt/artigos/the-d7-visa-.php?lang=en#:~:text=The%20D7%20visa%20is%20a,a%20period%20of%204%20months.

https://www.lvpadvogados.com/immigration

Hi, do you know which banks allow non-eu citizens to open banck accounts online?

Thank you,

Hi Gloria,

I would suggest contacting ActivoBank, Santander, and Millennium BCP.

Can one go through these steps without an immigration lawyer? They are too pricey!

You can go through the process without one. However, an immigration lawyer will make the process must easier as SEF can get quite bureaucratic 🙂

Hi Ij,

The one I got is affordable. I think it’s better one uses the lawyers as adviced by Laura.

Usonna

Hi,

Can you please share their contact? Much appreciated.

Hi Lara,

Great information.

The article mentions it can be a passive income or a remotely generated income for D7 visa such as digital nomads. Consider my case, I am a Seaman working on a permanent contract with an International Shipping Company. I have a decent salary. But since I am a seaman I have to work on board about 7 months a year. I go on and off for a 3 months contract followed by 3 months leave.

My job has 2 elements #1 the income is active not passive and #2 I would be leaving the Portugal for a short term to work at sea.

Does this qualify under D7 visa or any other category of visa for instance?

Kindly advice the procedure and the best options for us to settle in Portugal.

Hi Aftab,

I recommend contacting an immigration lawyer to look over these details. However, you are expected to spend at least 16 months in the country during the first 2-year period of your visa.

Does your 18 year old have to be studying in Portugal?

Hi Chris,

From my understanding, your 18 year old must be single and enrolled in an educational institution. I am not 100% sure if this must be in Portugal so I recommend contacting an immigration lawyer.

I and my wife have 1.9MM EUR equivalent net worth but the most asset is a non-dividend mutual fund. Do we need to sell them and buy similar ETF to earn dividend?

Hi Takahiro!

I recommend contacting an immigration lawyer or financial expert.

Can a Sri Lankan citizen apply for D7? Are there any restricitons for sri lanka? where can i find the application form for sri lankan.?

Hi Kamesh,

Any non-EU/EEA/Swiss citizens who have a passive income can apply for a Portugal D7 Visa so yes! I recommend you contact the nearest Portuguese embassy or an immigration lawyer.

if you found any lawyer or any in sri lanka who is doing this, pls share the details with me as I also need to process mine. [email protected]

Hi Lara

Is the Portuguese embassy open? How do I apply for my visa? Can I come to Portugal? i am from India I’m 25 years old. My education +2, diploma mechanical engineering please guide me. I want to be a citizen of Portugal

Hi Simranjit,

You should contact an immigration lawyer or your closest Portuguese embassy.

Hi Lara,

Thank you so much for all the information. Would you know if Portugal requires any funds to be deposited to the bank in Portugal or does D7 visa only requires opening an account no matter if any funds are deposited? Also, I am currently in another foreign country. Would I need the police clearance from this country as well as from my home country if I am applying for the visa from my home country? Appreciate your time.

Hi Iva,

I recommend contacting an immigration lawyer 🙂

hi my parents , Retired, lived in france permenantley for 20 years and now moved to Madeira last november , do they need a D7 Visa ?

if so if they need to visit the embassy in England can just one of them come over ? or can it be done remotley due to health reasons my dad finds it hard to travel.

I know they went about this wrong way and got bank account set up all utility bills and bought a house, they were never told they needed a visa until they tried to get health care and were advised they need a visa

please help !!

Hi,

I recommend contacting an immigration lawyer, they would be best to answer questions specific to your parents case

Their residency card from France – if still valid,serves in lieu of a schengen visa and they then have already ‘completed’ part 1 of the D7 visa – which, in essence is a schengen visa for 4 months.

They now need to decalre their residency in PT – it is the same for EU nationals, they still need to delcare/register their residency after 3 months and this is done via SEF

The struggle will be to get an appointment with SEF – I cannot even get through! Have been trying for close to 4 months now and some of my friends have been struggling for over 6 months!

SEF is inundated with residency applications – especially since the Ukranan war started. Once you get hold of SEF, and you have your appointment, this serves in lieu of an extension of the schengen/part1 of D7 visa.

Once you get to SEF, you need to provide all the docs.

Hope this helps you and good luck to us all! We LOVE Portugal and its people and feel so grateful to be here!

Keep BELIEVING! It WILL Happen!

I was convicted of Non dwelling burglary in 1987. Which was 35 years ago. I received a conditional discharge. Will this bar me from applying for the D7 visa.

Hi Brian!

I recommend contacting an immigration lawyer and asking about your situation.

Hi,

My Passive income is in 2 shapes

! ) 864 Euro / month

2 ) property + cars 835000 Euro ( together my wife and myself)

Are we both eligible to apply D7 visa?

Hi Narullah,

I recommend contacting an immigration lawyer.

D7 Application from Ireland….feels like something is wrong.

I am a Uk citizen living in Ireland hoping to retire to portugal on a D7. I had my appointment in the middle of January, and was told on the day that all my paperwork was perfect and the visa should be processed within 2 months….however we are now four months in and Ive heard nothing….I have tried to get updates from the e-visa portal but have hit a brick wall…no updates, no information…..Should I be worried ? I know that ireland does not do alot of D7 applications because Irish citizens do not need one obviously….maybe thats the problem…..all very frustrating.

Hi,

It could just be that SEF is overloaded at the moment but you can contact them by phone at 217115000 or 965903700

Hii Lara Silva i’m from pakistan and i’m 22 years old i’m doing job as a Web Designer. i want go portugal for work and live so which type of visa is suitable for me.please guide.

Hi Muhammad,

You should contact an immigration lawyer to help you with your case.

I am an Irish citizen, resident in Ireland, retired from teaching but would like to spend the winter months in Portugal (about 5/6 consecutive months every year) and the rest in Ireland. Because Ireland is not in the Schengen zone I understand that I need a D7 visa. Am I correct and if so can this be done from Ireland. Thank you.

Hi Marie,

I recommend contacting an immigration lawyer so that they can advise you.

Hi my parents may be considering the D7 visa to retire in Portugal we are from the US. My brother is 20 years old and is autistic but he is low functioning and cannot attend school. I am 22 years old and I could enroll in a school in Portugal to satisfy the dependent requirements for those 18+. Both my brother and I are unmarried so that requirement is satisfied as well. Would the Portuguese government make any exceptions for my 20 year old brother since he is autistic and is low functioning and cannot attend school like I could. Would my brother and I be able to still be counted as dependents on my Dad’s visa?? Thank you.

Hi Javier,

I recommend contacting an immigration lawyer in Portugal to ask about your situation.

Thanks for sharing. This article doesn’t mention anything on the social tax, especially for US citizens case, can someone elaborate? Everything tells that under NHR one is still liable for social tax in Portugal, or?

Can anyone suggest good Immigration layer / Firm who can assist with D7 VISA. I am a Sri Lankan who is staying in Malawi with work permit. Need to move to Portugal for my retirement.

I reach retirement age in January 2026, is it possible to buy a property in Portugal now while living outside of Portugal and rent it? Then use said property for living in while going through the 5/6 year process when I retire in 2026? My wife and I will meet the financial criteria required.

Hi William! I recommend contacting an immigration lawyer for your case.

I’m a Syrian who lives in Kuwait, can I apply?

There is no Portuguese embassy in Kuwait.

Hi Bia,

I recommend contacting an immigration lawyer in Portugal to help you apply.

Yes you can apply but via UAE embassy. You can also apply online.

Hey Lara!

Thanks for all these super detailed posts! I saw that you mentioned that we had to be in PT for 16mos out of the first two years, is that cumulative? And do I have to split them evenly or can I do 12 mos one year then 4mos the following? Also I tried looking on the Consulate website but couldn’t find anything about these exact terms, cause I was under the assumption it was 183 the first year but year two is fewer days.

Any insight appreciated!

I recommend contacting an immigration lawyer but from my understanding, it is not cumulative. However, do make sure to check this with an expert.

Hello,

If a family of 4 Members is applying then do all 4 members need to get an NIF before applying in their Home country or Only the Main Applicant needs it.

We are 2 children under 18 and our 2 parents. We 3 are dependent on our Father

Hello Muhammad,

I recommend contacting an immigration lawyer to help with your question.

I have invested my money in gold bullion so it is readily available by selling quantities to maintain an income.

Does my investment qualify as income for the D7 Visa?

Hi Nirda,

I recommend contacting an immigration lawyer to help with your question.

Hello!

Can I go to the Portugal from the country with no visa (Israel) and then convert it to the D7 in the portugal?

Not obtaining the temporary 4-months visa

Hello,

You should contact an immigration lawyer. However, as SEF is currently going through changes and is very slow, I do not think this is recommended. It will probably take more than 3 months for you to get a D7 visa.

Thank you for the answer!

Has anyone used the e-visa process to apply for a D-7 visa? I registered and went through the questionnaire and it sent me along to where it appears I can submit the application, upload all docs and check on the status of the visa all online.

I am just wondering if anyone has used this process and if it worked out for them?

Thank you.

No they dont even look at i see my Visa application sitting there

Hello and greeting everyone. I would like to know if the savings account balance have to be more if your are a family of 5? We meet the passive income requirement but I am not too sure if the amount in the savings account have to be more due to the fact that it is 5 of us.

Hi LaDesha,

The minimum passive income required is €8,460 per year for the main applicant. For a spouse, you must add 50% to this (€4,230) and for each dependent child, you must add 30% to this (€2,538). If by a family of 5 you mean yourself, one spouse, and three children you need this: €8,460 (yourself) + €4,230 (spouse) + €7614 (three children). You would need a little over €20,000.

However, we recommend contacting an immigration lawyer to make sure.

Is it a requirement to visit/scout Portugal before applying for the D7 visa?

No! You can hire an immigration firm to take care of everything.

Can one apply for the D7 visa if they are in their late 50’s (not quite retirement age 6yrs short of retirement), no passive income, and not a digital nomand but have over $300,000 in savings/investsments can they still apply?

Hi Belinda,

I recommend contacting an immigration lawyer. From my understanding, this is possible.

Thank you, Lara, for the detailed post! My spouse and I are planning to use the D7 visa to retire in Portugal next year. We’ll probably get in touch with an immigration attorney to help with the paperwork and processing, but this is an excellent summary with lots of useful information! Obrigado!

Hi There it seems like there is an ongoing issue of how long the turn around the D7 visa takes..its the basic retriement Visa …why so long when you hav your rental apartment your NIF number and you are paying for your condo or apoartment. They take for ever to give you notice on a residence D7 Visa in Toronto..why son logn..people are losing money ..They need o speed up the process.

For step one, how to get a NIF ? I m living in Hong Kong. Do you think I can open a Portugal offshore account through HSBC ?

For step two, I m not so familiar with Portugal, can I make a rental through airb&b on temporary basis.

I have a very thorough and comprehensive health insurance that I have been buying for more than 20 years. Is the hk health insurance acceptable by SEF appointment?

In the SEF appointment there requires a criminal record. But in Hong Kong, we need to state the reason of application of “no criminal record “ (usual reason : studying, work, etc.,). Can I use studying as a reason for criminal record? I’d it acceptable by SEF?

Many thanks for your info. You guys are amazing.

Keung

Hi Keung! Thanks so much! It’s best to contact an immigration lawyer to help you answer these questions. For example, when it comes to opening a bank account, a lot of times lawyers will do this for you if you cannot be in Portugal. It will make the whole process easier 🙂

Hi.

My wife and I both been issued with our SEF Temporary Visa papers now wait for the residency visa / card / certificate – maybe up to 3 months we were told by SEF.

In meantime can we travel back to our home country (uk) for 2 weeks during festive period, then be allowed back into Portugal? Our 4 month visit visa issued by consulate in Manchester has just expired..

Thanks

Robert

Hi Robert,

I recommend asking SEF or an immigration lawyer

Lara thanks for your useful information. Do you or any of the others here know what documents need to be provided for accommodation. i have a friend who owns a property and would privately rent to me. would that work/ regards, Sarah.

Hi Sarah,

From my understanding, you would need a rental contract.

Hi!

1. I’m confused about the “passive” part: I have remote income averaging around €1100 per month (€13,200 oer annum) from freelance work, in addition to stock holdings totalling €2000 (this fluctuates between €2000 and €3000 depending on market conditions), plus €2200 in cash savings which I can increase substantially within months by moving into the family home rent free in my hometown. So by the numbers, I satisfy the requirements, but the freelance income of €1100 per month is not “passive” by the dictionary meaning of the word, i.e. I do have to sit at my computer and put in the hours every month for companies and individuals around the world remotely.

Do I still meet the financial requirements?

2. Does the requirement for a rental contract in Portugal means I would need to start paying rent even before the visa is done and I arrive in Portugal?

Cheers!

Hi Shern! I recommend contacting an immigration lawyer. Most times, remote work qualifies for the d7 visa. And for question #2, most of the times, it could mean paying rent in advance. Again, speaking with a professional is advised.

Hi Lara,

I meet the passive income requirements , but would like to know if I can still work / look for work in Portugal once the D7 visa is approved.

Thanks:)

The D7 visa doesn’t give you the right to work in Portugal, but rather, work remotely.

Hi, I’m from NY, but currently in Korea and hoping to move permanently to Portugal. Do I have to move back to the US to start the Visa process? Or can I apply remotely.

I recommend contacting an immigration lawyer in Portugal, they will help you out. However, from my understanding, you need to apply at a Portuguese embassy in the US.

Hi Laura,

My wife and I are wanting to retire to Portugal. Where do we go to find/acquire an application for a D-7 visa?

We will be in Portugal starting the 1st. of January 2024 to open a bank account and hopefully get our tax# and health insurance. Do we both need to apply for the D-7 and health insurance or will one of us be sufficient to meet the requirements necessary for residency?

Laurens

Hi Laurens, we recommend contacting an immigration firm they will best advice you.

Hi Lara. My husband and I are dual citizens of Brasil and USA. We currently live in Florida, but we are researching on what it takes to move to the Azores. We have both American and Brazilian passports and we are both retied receiving Social Security benefits, but we are both working full time to make ends meet as everything here in the States is getting more and more expensive. I have googled the step by step instructions that we would need to reside in the Azores and it is not very helpful. We have a house here in Florida with very little owed on it and figure if we sell it, we would probably have enough to purchase something outright there eliminating mortgage payments, which we now have. Could you possibly help us or send us to someone to help as we research this possibility. Thank you very much.

Hello, if you wish to retire in the Azores, please take a look at our guide to retiring in Portugal. https://www.portugal.com/moving-to-portugal/expat-guide-to-retiring-in-portugal/?swcfpc=1

The D7 visa tends to be known as a visa for retirees, so we do recommend contacting an immigration firm that can best advise you on this visa and whether it makes sense for you.

Hi, Lara,

Just today completed my application in New York for the Long Stay Visa as the first step towards the D7. When granted a D7 is there a limitation on the max days that one can stay in Portugal in a year? And is that a calendar year or is the start mark at the first day of entry? Also, I understand one is permitted two entries and two exits per year. If so, with the recent changes does that remain true? Thank you so much. I’ve been following you on social media and really enjoy all of the posts – especially about the dancing!

Ric