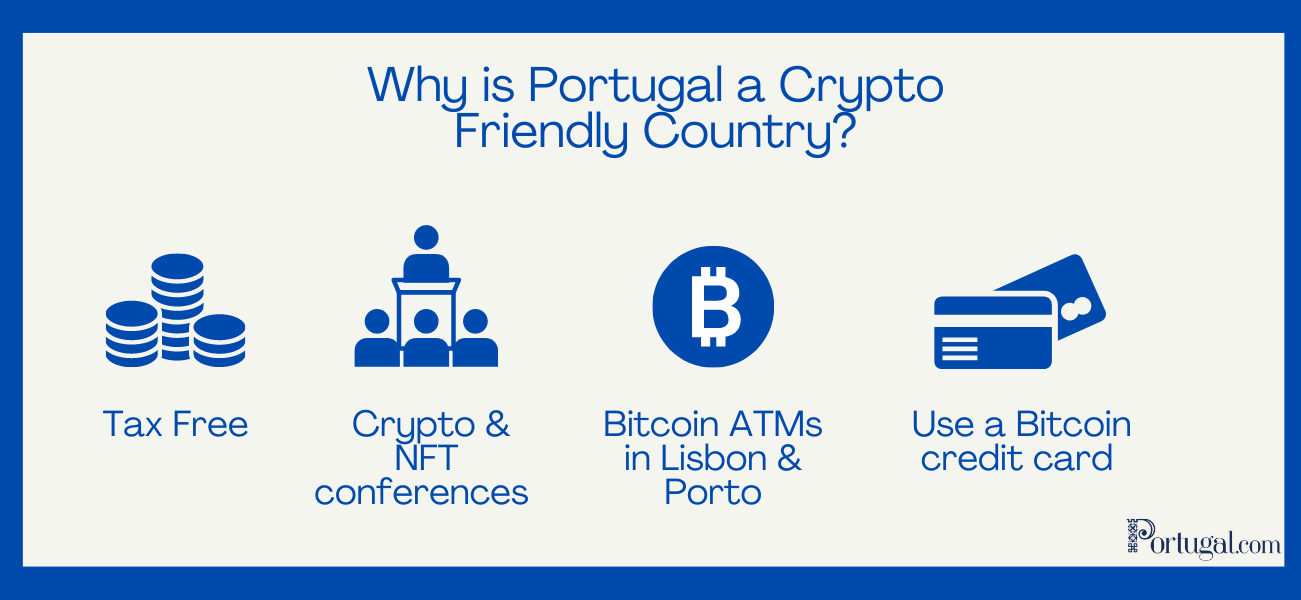

Portugal is one of the most crypto friendly countries in the world, despite introducing specific taxes on cryptocurrency investments in January 2023. Lisbon hosted an Ethereum conference in October of 2021 and is following the global trend of NFTs, having hosted Europe’s first crypto art festival, Rare Effect in May of 2021. More recent conferences include NEARCON and the Non Fungible Conference, which have been held for multiple years in Lisbon.

In the last few years, crypto companies have been on the rise in the country and changing the way the Portuguese view this industry. For example, Criptoloja was the first crypto exchange licensed by Portugal’s central bank to operate in Portugal, in October of 2021. The company now allows individuals to purchase over 200 different cryptocurrencies with euros. From being able to purchase products with a crypto visa card to favorable tax regulations on crypto, Portugal is one of the best places to be a crypto trader.

There is also an active crypto community in Portugal with regular meetups in Lisbon, Porto, Madeira, and even Caldas da Rainha. Lisbon even has a coworking space, the Block Lisboa, dedicated to the cryptocurrency industry, which hosts regular crypto meetups on Friday evenings.

Is Portugal a Tax Haven For Crypto?

Technically, yes, but there is a catch. Before January 2023, Portugal viewed cryptocurrencies solely as an asset, rather than as a form of payment and thus did not tax it as the former. Cryptocurrency was treated like any other currency, essentially. You would not be charged VAT or Personal Income Tax (IRS), as an individual.

Currently, businesses that provide services related to cryptocurrency are taxed on gains between 28% and 35%. If you trade cryptocurrency as your primary income source (as your main profession), you will also be taxed this amount. There are many factors that determine whether this is the case like your profit and the frequency of your trade. To be sure, contact a tax advisor in Portugal.

As of January 2023, profits from the purchase and sale of cryptocurrency are still tax-free as long as they are not your main source of income and you hold the coins or tokens for more than 365 days. This is still seen as very favorable compared to most other European jurisdictions. At times, Portuguese banks will contact you and ask you for a receipt or proof of exchange.

Moving to Portugal for Cryptocurrency Trading

Cryptocurrency and the Portugal Golden Visa

Applying for a Portugal Golden Visa is a great route for crypto investors to take. This way, you can enjoy the tax benefits of this crypto-friendly country. Created in 2012, the Portugal Golden Visa is known as one of the most attractive visa programs in the world. The program allows non-EU citizens to qualify for a residency permit and eventually a passport in the country through investments.

With a Portugal Golden Visa, you can live in Portugal and travel within most European countries without an issue. However, while you do not need to reside in Portugal to get a Golden Visa, you should do so to take advantage of the crypto tax incentives. Profits from purchase and sale of cryptocurrency is not taxed if you hold your coins or tokens for more than 365 days. To become a tax resident, you must spend more than 183 days of the year in Portugal.

You will need to make an investment to apply for the Portugal Golden Visa. A lot of people do not know this, but you can qualify for any of the investment options with crypto visa cards. Not only can you use crypto to qualify for a Portugal Golden Visa, but you will also benefit from the Portuguese system if you hold your crypto assets for more than one year.

We advise that you seek legal and financial advice before starting your application. See our full guide on how to get a Portugal Golden visa here.

Cryptocurrency and the Portugal D7 Visa

Also known as the Portugal passive income visa, the Portugal D7 Visa is a popular way in which cryptocurrency investors move to Portugal. The Portugal D7 Visa gives residency status to non-EU individuals, including retirees, who want to move to Portugal and have a regular passive income. You must prove that you have passive income, derived from a pension, rental, dividend, or investments. Here are the passive income requirements to be eligible:

- The main application must make at least 100% of the minimum wage (€9,840 per year as of Jan 2024)

- For the spouse or parents of the main applicant, you need at least 50% (€4,920 per year as of Jan 2024)

- For the dependent children of the main applicant, you need at least 30% (€2,952 per year as of Jan 2024)

- Therefore, for a couple with one child, you would need around €17,712 a year to be eligible for the D7 Visa.

This visa not only gives you the right to live in Portugal, but after five years of residence, you can also apply for Portuguese citizenship. We advise that you seek legal and financial advice before starting your application.

Frequently Asked Questions About Crypto In Portugal

Is crypto legal in Portugal?

Yes. Although it is not recognized as fiat currency, like the euro, you can legally trade crypto in Portugal. You can also cash out crypto into euros. It does not, however, have legal tender status, such as the euro, meaning it is not recognized by the government as a means to settle public debt and pay legal fines, for example.

Is Bitcoin legal in Portugal?

Yes, Bitcoin is legal in Portugal, as are all cryptocurrencies.

Is there a Bitcoin ATM in Portugal?

This one might sound like an urban myth, but yes. You can find a Bitcoin ATM in Portugal. However, these are very rare. You can find a couple in Lisbon and Porto.

Can you buy things with Bitcoin in Portugal?

You can purchase things with Bitcoin in places that would not necessarily accept the cryptocurrency using a bitcoin credit card. There have also been instances of people purchasing properties with cryptocurrencies such as Bitcoin, as well as Dogecoin, Ethereum, and Cardano in Portugal as Swiss crypto payment processor FNTX Capital Suisse partners with Portuguese property developer 355 Developments. Others are following in their footsteps. For example, the sports team Benfica accepts Bitcoin as payment for ticket purchases.

Portugal and crypto tax: is crypto tax-free in Portugal?

Yes, if you hold it for more than 365 days and it is not your main source of income. In this case, you will not be charged VAT or Personal Income Tax (IRS), as an individual. However, businesses that provide services related to cryptocurrency are taxed on their gains no matter how long that you hold the asset. Contact a tax advisor if you are unsure whether this applies to you.

Will crypto always be tax-free in Portugal if you hold for more than 365 days?

Probably not. However, in the near future, crypto will likely remain tax-free in Portugal as long as you hold your tokens or coins for more than 365 days.