Looking to move to Portugal and wondering how to navigate the complexity of Portuguese taxes? You have probably heard that Portugal has some pretty high income taxes, but in truth, new residents can benefit from much lower tax rates. The Portuguese tax year runs from 1 January to 31 December. Workers must complete their tax returns for 2021 between 1 April and 30 June 2022. Self-employed people can pay their tax in three installments, July, September, and December. This guide to taxes in Portugal has everything you need to know, from income and property tax to the non-habitual tax regime.

Do foreigners need to pay tax in Portugal?

If you are a tax resident in Portugal, meaning you reside in Portugal for 183 days or more a year, you need to pay income tax on your worldwide income. If you live in the country for less than 183 days, you only pay tax on what you earn in Portugal. However, many expats in Portugal can enjoy the non-habitual resident (NHR) tax regime.

Non-Habitual Resident (NHR) Tax Regime

The Non-Habitual Resident (NHR) tax regime in Portugal attracts thousands of residents by offering reduced tax rates and even full tax exemptions for the first ten years of residence. The NHR tax regime was introduced in 2009 and is available to all new tax residents in Portugal that were not tax residents in Portugal for the 5 years prior. Let’s go through the main benefit of the NHR tax regime.

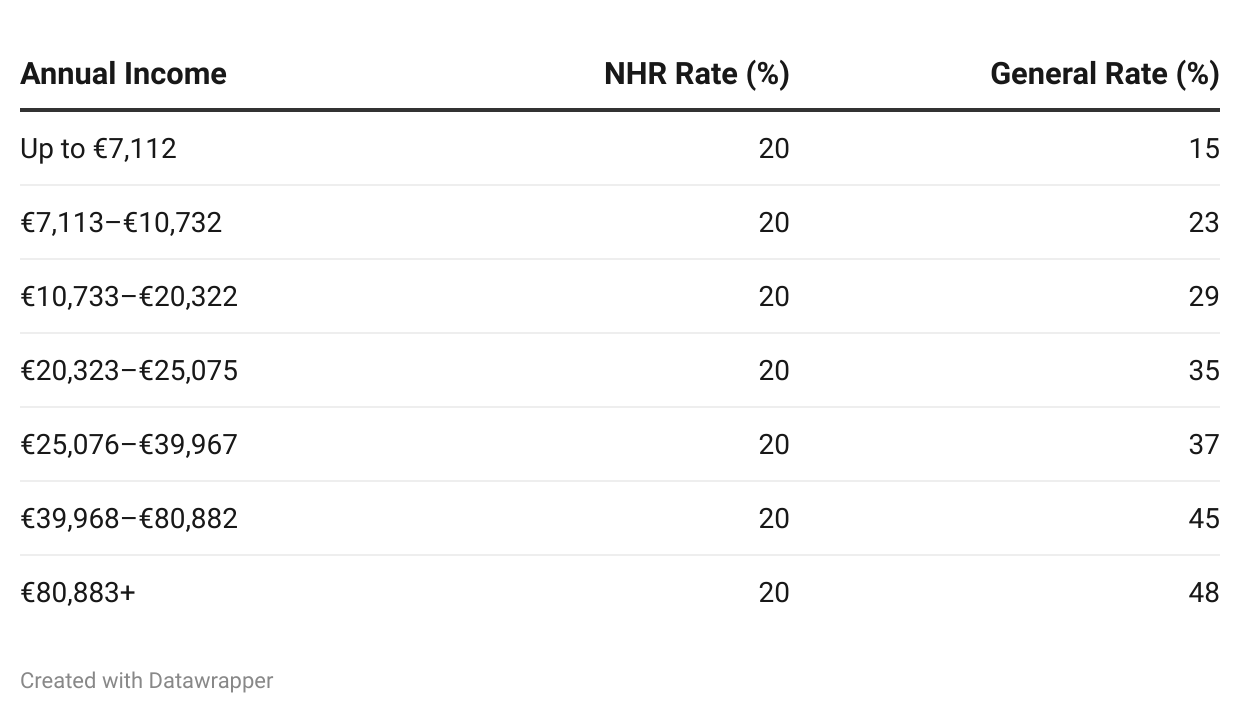

Personal Income Tax (IRS): 20% Flat Tax

Some NHRs are taxed at a flat rate of 20% on their income and are exempt from paying taxes on global income. Those who work in Portugal (freelance or regular employment) under the NHR tax regime only pay a 20% flat rate on personal income tax (IRS). To be considered “high value”, the job must be related to activities of scientific, artistic, or technical character. See what you would save below with a high-value tax rate under the regime.

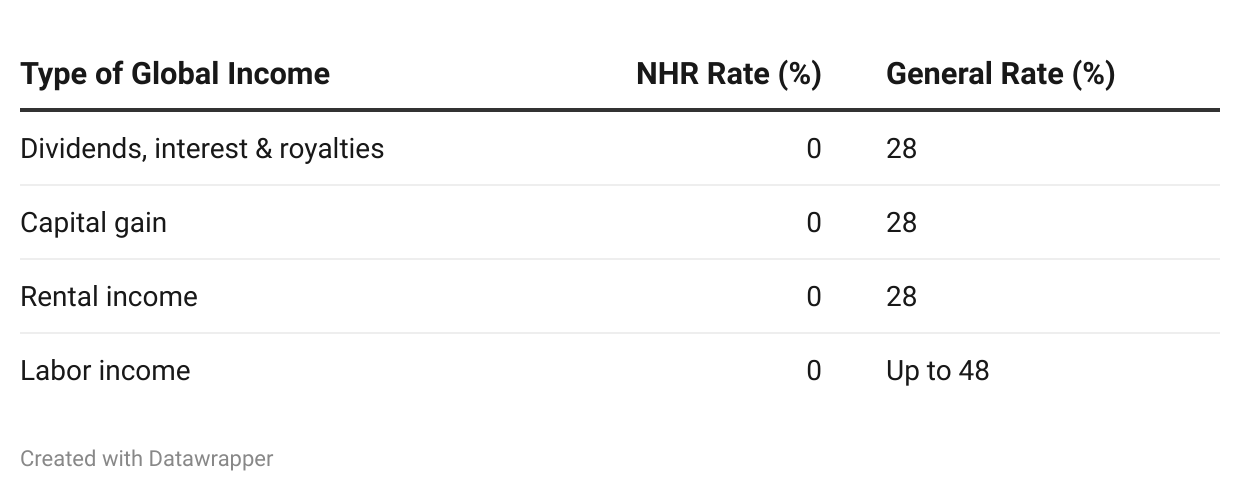

Global Income

You will also not pay any tax on dividends, interest, royalties, capital gains, rental income from real estate outside Portugal, and income from employment in another country. These will be paid in the source country if your country has a Double Taxation Agreement (DTA) with the country. The UK, USA, and many more countries have a DTA with Portugal where this is the case. Therefore, you could be working for an American or English company and not pay any income tax in Portugal under the DTA. Rather, you would pay taxes in the US. You could also just choose to pay the flat tax rate of 20% if you fall under a “highly qualified professional” or if the latter is the case and you are paid by a Portuguese source.

These benefits only last 10 years. Take a look at our guide to visas in Portugal to obtain long-term residency and be able to enjoy this attractive tax regime.

VAT in Portugal

Known as IVA in Portuguese, VAT is paid by consumers when purchasing goods and services. The seller receives the VAT and then pays it to the tax authorities.

The VAT rate varies around Portugal. For mainland Portugal, the rates are either 6%, 13%, and most commonly 23%. In the Azores, the VAT rate is either 5%, 10%, or 18%. In Madeira, the VAT rate is either 5%, 12%, or 22%.

Self-employed people and companies that produce, market, or provide products and services in Portugal must pay the VAT to tax authorities.

Income Tax in Portugal

If you can take advantage of the NHR tax regime, the general income tax rate will not apply to you. However, even under the NHR tax regime, after 10 years, you will have to pay the general income tax rate, also known as the imposto sobre o rendimento de pessoas singulares (IRS) in Portugal. Most workers pay taxes automatically through their pay slips, but everyone must still complete an annual tax return. If you are married, you must submit a joint return with your partner. To calculate the tax rate applied to you as a married couple, your collective income will be divided into two. The rates below are applied currently.

Tax Reductions Under Proposed State Budget 2022-2023

However, under the new state budget, the tax rate will be altered from 7 tax brackets to 9, making it more progressive and fiscally unburdening the middle class. There will also be tax benefits for those with a second child. These proposed changes under the state budget are set to pass as the Socialist Party (PS) now holds a majority in parliament.

In a simulation for TVI/CNN Portugal, the consulting firm PwC estimates that a single person without children with a gross income of €1.250 per month will save €53 a year due to tax bracket change. This value doubles for couples without children with the same gross income. Couples with children will save even more.

Do you pay income tax if you are self-employed in Portugal?

Yes. Freelancers and those that are self-employed in Portugal pay income tax, rather than a corporate tax. Therefore, the general IRS rates apply, unless you can take advantage of the NHR tax regime or the 10 years of your status are over. You will also be paying your own social security, taxed at 21.4% for self-employed individuals. Self-employed people with a turnover of more than €10,000 on taxable goods and services must also pay VAT.

You can also deduct business expenses such as the rent of your office and utility bills, which will not be calculated in your taxable income. However, there are limits to this. Expenses for travel and entertaining clients can only be deducted if they amount to less than 10% of your overall income. If you work from home, you can claim expenses up to 25% of your overall income.

Freelancers can also take advantage of the simplified regime where they pay income tax on 75% of their overall income and the remaining 25% is offset with expense receipts. If you make over €200,000 you aren’t eligible for the simplified regime.

Corporate Tax in Portugal

Corporate tax is set at a flat rate of 21% on taxable profit, slightly below the EU average. Small and medium-sized businesses paid a discount fee of 17% in mainland Portugal, 11.9% in Madeira, and 12.5% in other areas on their first €25,000 of taxable profit.

If your company turns over more than €10,000 a year, you’ll need to pay VAT. Along with corporate tax, you need to pay a surcharge to your local municipality, at around 1.5% on the profit charged by the regional municipality. Other surcharges on top of your corporate tax bill include:

- 3% state charge on profit between €1.5 million and €7.5 million (2.1% in Madeira, 2.4% in the Azores)

- 5% surcharge on profit between €7.5 million and €35 million (3.5% in Madeira, 4% in the Azores)

- 9% surcharge on profit over €35 million (6.3% in Madeira, 7.2% in the Azores)

Social Security

If you are working in Portugal, either employed or self-employed, you will also have to pay social security which will one day assure you a retirement pension. The Portuguese Social Security is a system that also secures the basic rights of citizens and ensures equality in opportunities, providing measures of support such as unemployment allowances, paternal leave, and other financial support.

Employees pay 11%, while their employers pay 23.75%. Those who are self-employed pay 21.4%.

Inheritance Tax in Portugal

Inheritance tax has been abolished a few years ago, but you must still pay stamp duty, Imposto de Selo, which is 10%. In Portugal, inheritance law follows forced heirship rules. This means that legitimate heirs get a minimum of 50% of the deceased's estate. If there is more than one, this usually increases to 60%.

There is no wealth tax in Portugal.

Property Taxes in Portugal

If you are buying a house in Portugal, you must pay a number of property taxes to the government. You’ll need to calculate each of them, which a Portugal property tax calculator is helpful. Property owners have to pay three types of taxes:

1. Municipal Property Tax (IMI)

The IMI translates to Imposto Municipal Sobre Imóveis and will be different in each municipality. This money is used to maintain public infrastructures in municipalities. The IMI rates usually range from 0.3% to 0.45%. To calculate the IMI, you multiply the value of the tax asset with the IMI rate. You must pay the IMI every year. For example, if your property is valued at €500,000 and you live in the municipality of Cascais with a rate of 0.34%, then your yearly IMI is €1,700. You can be exempted from the IMI if your annual taxable income of the whole household does not surpass €15,295.

2. Property Purchase Tax (IMT)

The IMT is also known as the Imposto Municipal sobre as Transmissões Onerosas de Imóveis. This tax is paid when a house is bought in Portugal, so it is a one-time payment for buying a house. The rate of the IMT will depend on the type and value of the property, as well as whether this property is a principal or secondary residence. You must pay this before you buy a house. This is how you calculate the IMT = value of the deed or net worth tax (the larger amount) x rate – tax reduction. You won’t have to pay IMT if you buy a house in mainland Portugal and the price doesn’t exceed €92,407. IMT usually will range between 2% to 8%, depending on the case. However, properties acquired by companies located in a “blacklisted jurisdiction” pay 10% for IMT.

3. Tax on Stamps (IS)

You’ll also need to pay an Imposto de Selo, a stamp tax, contracts, loans, documents, and more. The rate also changes depending on the property and task, but it is usually between 0.4% and 0.8%. For example, for a mortgage of five years, the stamp duty tax is 0.6%.

Guide to Real Estate in Portugal

Taxes on Cryptocurrency: Is Portugal a crypto tax haven?

The Portuguese Tax & Customs Authority (PTA) officially announced in 2019 that buying or selling cryptocurrency in Portugal is tax-free. Portugal does not view cryptocurrencies as an asset, but rather as a form of payment so they do not tax it as the former. Cryptocurrency is treated like any other currency, essentially. You will not be charged VAT or Personal Income Tax (IRS), as an individual. However, businesses that provide services related to cryptocurrency are taxed on gains between 28% and 35%. If you trade cryptocurrency as your primary income source (as your main profession) you will also be taxed this amount. There are many factors that determine whether this is the case like your profit and the frequency of your trade. To be sure, contact a tax advisor in Portugal.

If this is not the case for you, you can cash out your crypto into fiat currency (euro) without paying any tax. At times, Portuguese banks will contact you and ask you for a receipt or proof of exchange.

However, this is likely to change in the near future. In mid-May 2022, The new Minister of Finance Fernando Medina confirmed in parliament that cryptocurrencies will be subject to taxation in the future. While details are not yet set in place for the taxation of crypto in Portugal, the government has said the future plan will include, among others, a tax on the gains of selling cryptocurrencies such as bitcoin. The Secretary of State for Fiscal Issues Mendonça Mendes also announced that the government will not only tax crypto gains but cryptocurrencies will be included in other types of taxation, such as VAT (known as IVA) and Stamp Tax (known as Imposto de Selo).

Hi, what about the employer. Are there any obligations on the employer who is not based in portugal but you are?

Is it only social security they would register for and is there a cost?

Hi Nicole,

I recommend contacting an accountant in Portugal. However, I believe that if you are asking about working remotely in Portugal for a foreign company, you would work as a freelancer. You would therefore pay your own social security which for freelancers is 21.4% and be in charge of filing your own taxes. You could also set up your own company and work as a contractor for the foreign company, but again, I recommend contacting an accountant to review your options.

As a Portuguese citizen returning to Portugal from United States as a NHR and being taxed in the USA from my 401 k and defined benefit pensions at Federal level do I pay extra taxes in Portugal from this income ?

Does a NHR working for a company in US, therefore not paying any taxes in Portugal, need to pay Portuguese Social Security separately?

Thanks,

Hi Alex,

I recommend contacting an accountant in Portugal.

Hi Lara,

how high is the tax on profits made by trading stocks and options being NHR program?

Thank you

Hi Tom,

Capital gains are usually not taxed in Portugal under the NHR program if they come from a country with a Double Taxation Agreement (DTA). You might still not be taxed if the country does not have a DTA, unless it is a blacklisted tax haven. The best way to find out about your particular situation is to contact an accountant or immigration firm specialized in the NHR regime.

Hi Lara,

amazing explanations!

I am desperately searching for a very common case: Being employed in a company AND being self-employed (a freelancer). What are the steps you need to do, when you want to start freelancing beside working at your normal job? How do the income tax, VAT and social security apply here?

Feel free to also give me a contact. I would be open to book a session for this.

Thank you and kind regards,

Jennifer

Hi Jennifer,

I recommend contacting an accountant as they will help you out with our income tax, vat, social security, etc. The difference between these two types of work is that you would use the “recibos verdes” system for your freelance work only. VAT also only applies to your freelance work usually. However, again, it’s best to look for an accountant in Portugal to help you out. At the moment, we cannot yet provide you with a contact, but we are working on building a directory in the future with contacts for such services.

So if you are married and you each make 30000 your taxable income would be 60000 but then its divided by 2.. So you would then be taxed at 35% but are you taxed on the 30000 or on 60000?

Hi Dan,

I recommend contacting an accountant to asses your situation. However, in Portugal, when you are married, you can opt to file your income taxes together if you wish.