Registering a rental contract in Portugal is a legal requirement that directly affects your tax rights, access to housing programs, and ability to prove legal residence. While landlords have traditionally been responsible for registering leases with the tax authorities, Portuguese law now gives tenants an important safeguard when that obligation is ignored.

As of August 1, 2025, tenants and subtenants can register a rental contract themselves if the landlord fails to declare it within the legal deadline. This change strengthens tenant protections and ensures that renters are not penalized for a landlord’s non-compliance. Below is a clear and practical guide to how the system works, why registration matters, and how to complete the process step by step.

Why Rental Contract Registration Matters

In Portugal, all long term rental agreements must be communicated to the tax authorities. This registration creates an official record of the lease and ties it to both the landlord’s and tenant’s tax profiles.

For tenants, a registered contract is essential for several reasons:

You can deduct rent payments on your annual IRS income tax return, which can significantly reduce your tax bill.

You become eligible for housing support programs such as Porta 65, which provides rental assistance to qualifying tenants.

You have formal proof of your residency, which can be important for residency applications, address registration, school enrollment, and other administrative processes.

Without registration, your lease effectively exists only as a private agreement, which leaves you exposed if disputes arise or if you need to demonstrate your legal right to occupy the property.

Who Is Responsible for Registering the Contract

Under Portuguese law, the landlord must register the rental contract with the tax authorities by the end of the month following the start of the lease. This obligation applies whether the landlord is an individual or a company.

However, since August 1, 2025, tenants and subtenants are legally allowed to step in if the landlord does not comply. This right exists specifically to protect tenants and does not relieve landlords of their original legal responsibility or potential penalties.

How to Check if Your Contract Is Already Registered

Before taking any action, you should verify whether your landlord has already registered the lease.

Log in to the Portal das Finanças using your NIF and password.

Navigate to the Arrendamento section and look for the option labeled “Consultar Contratos” (Consult Contracts). If your lease appears there, it has already been properly registered and no further action is required from you.

If the contract does not appear and the legal deadline has passed, you are entitled to register it yourself.

Step by Step Guide to Registering the Contract as a Tenant

Once logged in to the Portal das Finanças, follow these steps carefully.

First, go to the “Cidadãos” (Citizens area)

and then click on “Serviços” (Services), which should be the third option down.

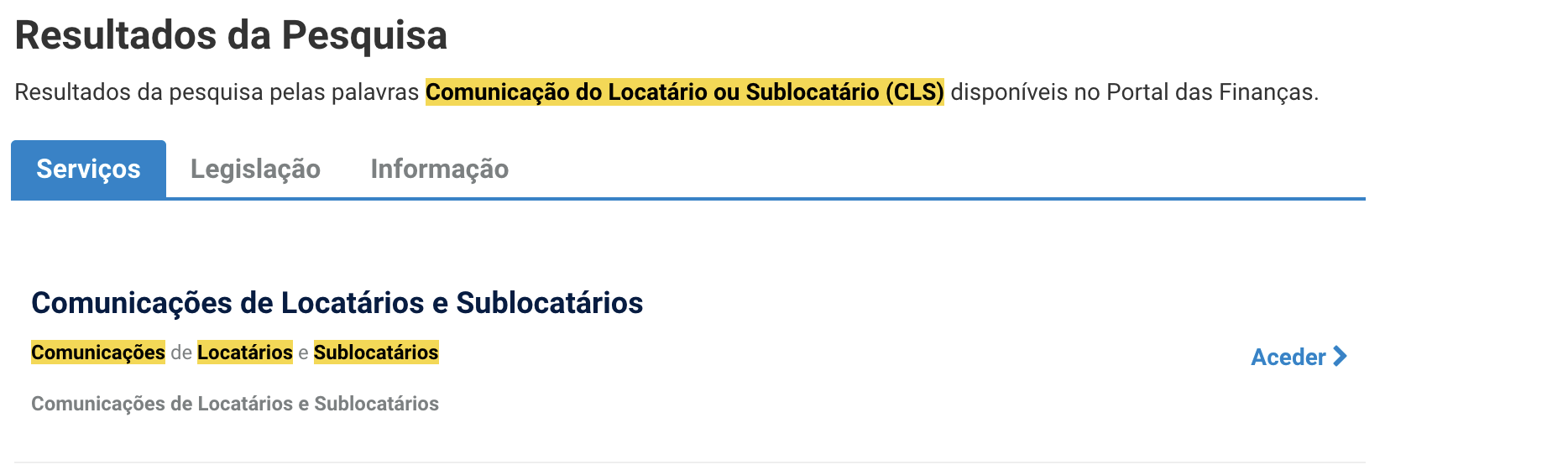

Within this section, type in “Comunicação do Locatário ou Sublocatário (CLS)” and click “enter” or “return” on your keyboard.

Then, click on “Communicar Contrato” in the screenshot below.

Here, you can enter the details of your contract as a tenant. You can translate this page in your browser if you are not confident with the Portuguese. When you are finished, please click on “Guardar Rascunho” to save your information at the end.

Review all information that you’ve entered carefully. Confirm the property details, lease dates, and personal data. Once everything is correct, submit the declaration.

After submission, the contract becomes part of the official tax record. You should keep a copy or confirmation of the submission for your records.

What Happens After Submission

Once the contract is registered, it is treated as if it had been properly declared from the beginning. This means you can include rent payments in your IRS deductions and rely on the contract for administrative purposes.

The landlord may still face consequences for failing to register the lease on time, but that process is handled separately by the tax authorities and does not affect your rights as a tenant.

Common Questions and Practical Tips

Many tenants worry that registering the contract themselves could create conflict with the landlord. While this concern is understandable, the law explicitly allows tenant registration and exists to protect you. Registering the contract does not invalidate the lease or give the landlord grounds for retaliation.

You should also ensure that the information in the contract is accurate before submission. Incorrect dates, missing signatures, or mismatched property details can delay acceptance or create future issues.

If you are a foreign resident or a new arrival, having a registered lease is particularly important. It often serves as proof of address and lawful housing when dealing with immigration authorities, banks, and public services.

Final Thoughts

Portugal’s rental registration system is designed to promote transparency and fairness in the housing market. The ability for tenants to register a contract themselves represents a significant improvement in tenant protections and ensures that renters are not left in limbo due to a landlord’s inaction.

If you are renting in Portugal, checking your contract registration status should be a priority. If necessary, using the tenant registration process is a legitimate and effective way to protect your rights, access tax benefits, and ensure that your housing situation is formally recognized.